RealtyShares Review – A Smart Way To Invest In Real Estate!

Welcome to my RealtyShares review!

If there was one thing that any financial expert would have told you, it would be to invest in Real Estate.

While the advice holds true, it’s not that accessible for the vast majority.

But what if there was a way for you to be a passive real estate investor?

Then allow me to introduce RealtyShares.

First of all, I must Congratulate you for taking your time to do your own research before buying into any "seemingly good" product.

That's the way to avoid scams and find the legitimate way to make money online!

Let me be completely transparent with you, I'm not associated with RealtyShares in any form.

So, rest assured that I'm not here to pitch or sell anything to you.

Instead, I'm here to reveal what makes this a great way to start investing in real estate.

RealtyShares Review Summary

Product Name: RealtyShares

Founder: Benjamin and Daniel Miller

Product Type: Real Estate Investment and Wealth Management Platform

Price: Free to Sign Up + Various Annual Fees!

Best For: People who meet the requirements to be an investor for RealtyShares.

Summary: RealtyShares is a real estate investment and wealth management platform that's supposed to make it easy for you to get started with real estate investment. However, there are certain drawbacks that make me not want to recommend this program to anyone. First, the investments are not liquid so you just can't sell your investments to get the cash back. You have to wait till the hold period of the investment is over before you can pull out your cash. This puts you at a financial disadvantage in case you need cash for an emergency. Second, RealtyShares requires you to qualify as an investor before you can start investing. The requirements are listed in the article, so you'll have to see for yourself if you meet one of them.

Rating: 40/100

Recommended: No

More...

What is RealtyShares?

RealtyShares is an online investment platform that focuses on real estate investments.

It’s used by investors, borrowers, and sponsors, and allows all transactions to be carried out through the website.

Unlike the larger real estate investment platforms, RealtyShares is more on building smaller investments, and this includes legitimate business strategies such as single-house family flips.

In 2014, RealtyShares covered $300 million in real estate property value spread out on more than 200 properties in different cities from 17 different states.

The Management Team

RealtyShares’ leadership is the reason why the platform is doing a lot better than most platforms.

The founding brothers, Benjamin and Daniel Miller, are sons of noted Washington DC real estate developer Herb Miller.

Realty Shares Management Team

Benjamin Miller is the CEO of RealtyShares and has 15 years of experience in both finance and real estate.

He worked on $500 million of property as a managing partner of WestMill Capital Partners.

Brandon Jenkins serves as the COO and helps to run both design and tech teams to ensure that the software platform is running smoothly.

He was also an investment advisor and broker for Marcus and Millichap, the biggest real estate investment brokerage firm in the USA.

Kenny Shin serves as the CTO for the company, but his previous experience with consulting for Fortune 500 Companies in the finance and technology area has allowed him to bring RealtyShares to where it is at today.

Inside RealtyShares

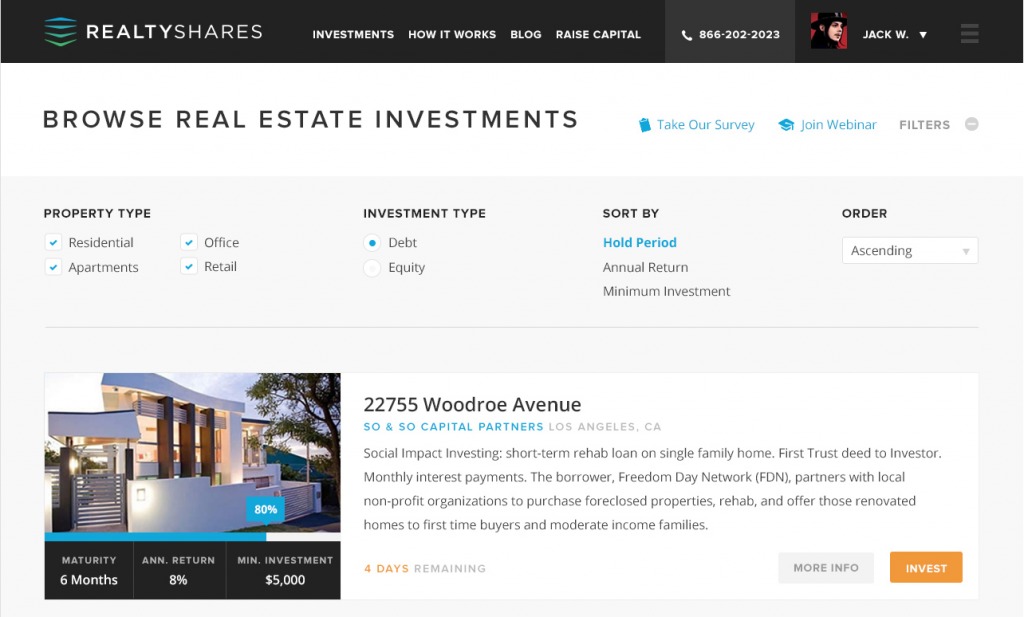

RealtyShares is an investment platform with a keen focus on real estate investment.

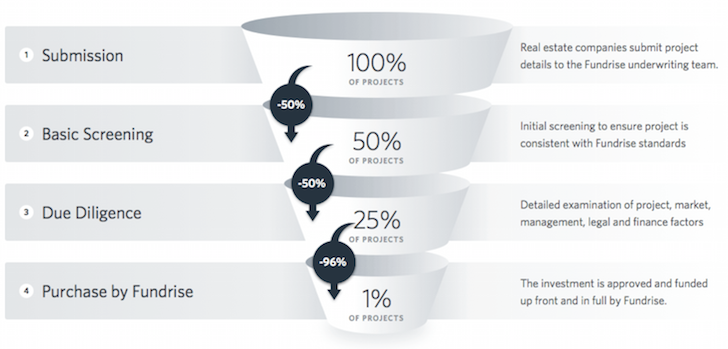

The platform reviews all investment opportunities to make sure that they meet the criteria for the platform.

If it does, the investment is listed on the site and will include the general information about the deal and the legal documents that cover the risk factors and other details connected to the transaction.

Investors can purchase smaller investments of a larger investment to an entire investment.

The site dashboard will allow you to track your earnings history of the investment and provides you with year-end investor tax information.

Investors can choose to fund either equity investments or real estate loans. Apart from residential properties, RealtyShares also provides you investments on commercial property.

There is a simple five-step process in order to invest on RealtyShares:

- Sign up for the platform

- Choose through real estate investments (note that there is a first a 30-day SEC “cooling off” period)

- View and finalize your investments

- Wait for the funding goal to be met for the investment (100% funding)

- Manage your real estate investments online

Investor Guidelines

If you want to invest with RealtyShares, you have to qualify as an Accredited Investor.

This means you should have a net worth of over $1 million, or joint net worth with your spouse. This also includes a primary residence and a yearly income of at least $200,000 in the last two years, or a joint annual income of $300,000 with your spouse.

The minimum investment is $5,000, but there are certain projects that have a minimum investment of $1,000.

The investment process in a nutshell

Once you find an investment that you’re interested in, you can access a page with information about the property.

This includes the financials, the property management, and other financial and legal documents.

RealtyShares will also be doing all of the due diligence that you would normally do, and they even perform background checks on the key executives on the people involved in each project.

Once that’s done , the next step is to finalize the investment. Each property will have to meet a funding goal before you can buy shares.

You can sign and send all documents and transfer money electronically via the bank account linked to your account.

The money is then held in an escrow account. If the goal is not met, 100% of your money is returned.

I'm Jerry!

I Created My Own 4-Figure Monthly Passive Income at just 21 Years Old!

What Are The Fees?

It’s free to open an account with RealtyShares and browse all available properties.

Once you’ve made an equity or preferred equity investment, you’re charged an annual fee of 1% of the aggregate amount invested.

For equity investments, RealtyShares take a cost reimbursement and a 1-2% management fee.

This is lower than what most property management companies would charge you on any residential rental property, which hovers at about 8-12% of one month’s rent plus expenses.

Debt investments charges a service fee based on the spread bet between interest rate the borrower is paying and the rate being paid to investors.

Investment Options

Once you qualify as an investor for RealtyShares, you have two choices: Debt Investment and Equity Investment.

- Debt Investment: Your money is used as a loan to the company handling the project and you earn via the interest charged.

- Equity Investment: Investors have indirect ownership so they are able to participate in the project’s excess cash flow and any appreciation realized at the time of the sale.

Investment Categories

Then there are the different categories of investments.

- Single Family Rental Property: You can invest in single-family homes where you have first position in the lien. The target return is 9 to 11% annually, and the term of investment is between 6 and 24 months.

- Preferred Equity/Mezzanine Debt: The investment period is between 2 and 3 years, but mostly involves commercial properties. The target rate is 12 to 14%. This is where a quarter of RealtyShares investors invest in.

- Joint Venture Equity: This investment makes you equity owners along with the sponsor, and you share in the profits once the preferred returns are reached. The target return is 10 to 16% annually and lasts between 3 and 5 years.

Who's RealtyShares For?

While it’s a smart way to get into real estate investments, it’s a platform that’s not meant for anyone.

As mentioned above, RealtyShares is for anyone who meets the requirements to become an investor.

RealtyShares Ugly Truths Revealed!

#1 – Investments Are Not Liquid!

You can’t decide to just sell an investment with RealtyShares just to get your money back.

Each investment has a specified “hold period”, which hover between 6 months and 5 minutes.

This hold period is just an estimate, so the hold time may either be shorter or longer.

This is a disadvantage because in case of financial emergencies, you don’t have access to the cash you have in your account.

And note that because of the $5,000 minimum investment, you’re locking yourself out of $5,000.

#2 – Investor Requirements For RealtyShares Makes It Inaccessible!

You have to qualify as an investor in order to start investing. This limits the opportunity for people to get into the investment program.

This is also odd because most investment platforms don’t really have this requirement, instead they focus more on the minimum investment amount.

#3 – A Capital Call May Be Done For Some Investors!

Sometimes, current investors may have to come up with more capital for a particular real estate project if it needs more money.

RealtyShares tries to minimize this to the best of its abilities, but when it does happen, it may put you in a bad financial position.

What I Like About RealtyShares?

#1 – Minimum Investment Of $5,000!

RealtyShares tries to investment requirements very low, averaging at $5,000.

There is no maximum investment limitation as well.

This is great because you don’t need to shell out a lot of money to get things started.

Is RealtyShares a Scam?

RealtyShares is a legitimate investment platform if you want to get started with real estate investment. But there are certain restrictions that limits itself to a lot of ordinary Joe’s and Jane’s, and to even high-income investors.

You’re putting yourself at a financial chokehold because the investments are not liquid. Meaning, you can’t cash out at any time for any reason until the hold period is done.

This literally limits your finances because you don’t have access to the cash you’ve invested into the properties.

And to start investing in properties, you have to qualify as an investor for RealtyShares.

The requirements to become an investor involves having enough annual income to secure both finances and investments.

But if you do qualify as an investor, and if you have the capital for it, then RealtyShares is worth looking into.

How I Make a Living Online?

I've personally created a 4-Figure Monthly Passive Income Stream and become financially independent at just 21 years old without any College degree or working experience!

Through my own hard work, I went from a broke restaurant waiter to living my dream laptop lifestyle in less than a year's time...

If you want to discover the secrets of how I did it at such a young age, click here!